Post-closing issues are often forgotten by the real estate agent, the closing attorney, and even the buyer. Often buyers assume these post-closing issues just happen automatically.

Post-closing issues are often forgotten by the real estate agent, the closing attorney, and even the buyer. Often buyers assume these post-closing issues just happen automatically.

Well, in Costa Rica, nothing goes automatically. That’s why I asked attorney Roger Petersen to help us out and write a blog about it.

These post-closing issues seem so simple, and they are. You only have to wait until the property you just bought, becomes yours in the National Registry. Once it is, your attorney can give you the necessary documents or you can pull it yourself online.

Utilities

How to deal with the utilities on the Property that you have purchased is one of the most important posts closing issues. If you don’t get this out of the way, you might have water, power or any other important utility disconnected.

(a) Changing the Name on the Utility Bills

The transfer of the utilities is the responsibility of the new property owner. Once the National Registry records the property title transfer, the buyer can request the transfer. Although this would appear to be a simple task, in Costa Rica it is not. The telephone company will not transfer a telephone line in many cases. In this case, I suggest the Buyer uses the telephone line and leave it in the name of the Seller.

Where possible the Seller should issue a Power of Attorney to the Buyer at closing. Then the buyer can issue instructions to the phone company regarding the use of the telephone line. If the Buyer wants the electric and water bills changed to their name they can do so. But the Attorney will charge for this service since it is not part of the legal closing service. Ideally, the real estate agent should assist the Buyer in completing these processes as part of his/her tasks to take care of all post-closing issues.

(b) Delivery of Utility Bills to the New Owner of the property.

The Real Estate Agent should obtain copies of the utilities installed on the property [electric, water, telephone, cable TV, Internet] to determine where the bills are being mailed or delivered. Some property owners have the bills sent to the property while others may have it sent to a post office box which they own. If they go to a Post Office Box and the Seller does not need it anymore then try and get them to give the Box to the Buyer as part of closing. This will ensure that there are no interruptions in the services which could be a great inconvenience to your Buyer.

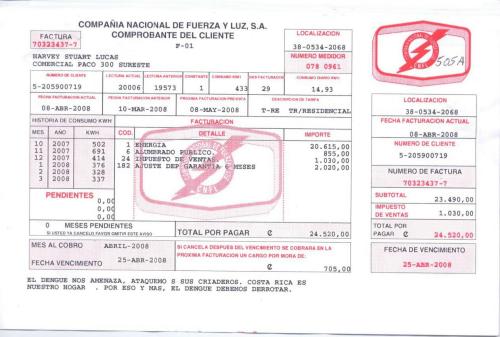

![Declaration of Property Value [Declaracion de Bienes Inmuebles]. Post Closing Issues by Attorney Roger Petersen](https://livingcostarica.com/wp-content/uploads/2022/05/BienesInmueblessm.jpg)

The Local Municipal Government

A registrar records the deed in the Property Section of the National Registry. This is the official national registry for recording titles to property. However, you pay property taxes at your local Municipal Government.

To this date, the two are not automatically connected. This means that just because a sales deed is recorded in the National Registry, it does not mean that the Municipal government where the property is located knows about it.

Once the buyer receives the recorded property transfer deed back from the closing Attorney, it is the buyer’s responsibility to hand carry a copy to the Municipal government to inform them of the transfer. Then, the Municipality can collect property taxes from the new owner.

When the Buyer approaches the Municipal government to update the ownership information they may be required to fill out a Declaration of Property Value [Declaración de Bienes Inmuebles].

The property tax law requires that this form is filled out by property owners every five [5] years. The Municipal Government uses this form as the basis to establish the value of the property. This, in turn, is used to calculate the property tax.

At present, the property tax rate is 0.25% of the value of the property and it is paid quarterly.

Some property owners elect not to fill out the form and by not doing so the Municipal Government has the right to conduct an appraisal of the property and set the property tax.

The Author

Real Estate attorney Roger Petersen is also the author of the book The Legal Guide To Costa Rica and the Complete Guide to property taxes and the new Luxury Home Tax in Costa Rica.

Finally, feel free to leave your comments on this blog. If you like this article, please also feel free to share it on your social media.

If you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

While we’re at it, I DO want to remind you that we appreciate any referrals you can send us. Finally, please remember the American-European real estate Group’s agents when you refer a real estate agent. Because we DO appreciate your business. Therefore, we are very good at what we do.