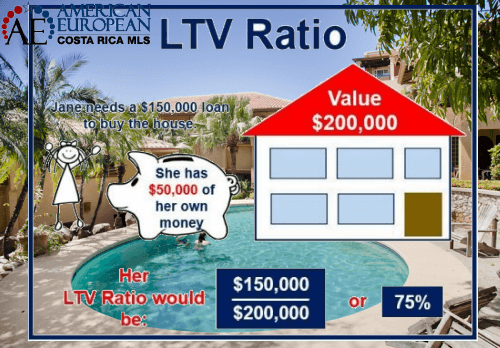

Loan to value ratio or LTV is a ratio that reflects the relationship between how much you borrow and the appraised value of your property.

For example, Joan wants to purchase a home for $100,000. She plans to make a down payment of 10 percent ($10,000) and finance the rest. This means her loan is for $90,000, and her loan to value ratio is 90 percent.

The term LTV is commonly used by banks and lenders to represent the ratio of the first mortgage as a percentage of the total appraised value of the property. In general, the higher the LTV ratio, the riskier the loan is for a lender.

LTV varies

When the risk for the lender is higher, they will lend based on a lower LTV ratio. Loan to Value is an important tool used by lenders to measure risk.

Lenders in Costa Rica use a different LTV ratio, depending on the type of property.

Banks

Banks usually have a different loan to value ratio for raw land than for constructed property:

- 80% LTV for a constructed property purchase.

- 70% LTV for a building lot purchase.

Some banks financing buyers in new real estate developments allow 100% LTV now.

Private Lenders

Private lenders and hard money lenders usually don’t lend on raw land, because there is a much higher risk to sell land well after foreclosure.

On constructed property, private lenders usually lend at 50 – 60% LTV. Are you interested in contacting a private lender (for residential lending only), fill out the form below:

[gravityform id=”5″ title=”false” description=”false” ajax=”true”]

Refinance

Many lenders won’t refinance a loan unless you have an LTV of 75% or less. Costa Rica Mortgage solution will be able to get a much more comfortable LTV for your refinance, depending on the risk. Learn more now.

Appraisal

The value of a property is typically determined by an appraiser. Many times the lender will also take into consideration if the property has been sold recently, and what the selling price was. Usually, banks will use the lesser of the appraised value and purchase price to determine how much they will lend a borrower. Especially, if the purchase is within 1–2 years.

Criteria

When you start looking at mortgages being offered to you, lenders look at several criteria:

- Your minimum required income for the loan amount,

- The minimum deposit you must put down,

- Credit history,

- The number of working years you have left,

- One of the most important determining factors is the lender’s maximum Loan to Value (LTV) ratio.

Interest rate

Lenders in Costa Rica do not lower the interest rate if the LTV is lower, but U.S. lenders do.

It is very important to know that a U.S. lender does give much better terms on a lower Loan to Value Ratio. For example, a mortgage with a maximum Loan to Value Ratio of 50% would probably have a lower interest rate since the risk for the lender is less.

The more of your own money you use to make the purchase, the less of the lender’s money is at risk.

The Author

Steve Wool was a top mortgage originator for Capital First, the largest refinance company in Florida, for 7 consecutive years. He wrote the manual for Costa Rica Mortgage Company and trained all their salespeople. Steve possesses a wealth of experience and knowledge has generated millions of dollars in loans over the years.