The very first time I had any idea what title insurance was all about was in 2002. In Costa Rica, title insurance was not customary.

Only INS, the local insurance company, could sell insurance, by monopoly regulations. Not until 2008, President Oscar Arias signed a new law that opened up the insurance market in Costa Rica. Even then, title insurance was not part of it.

When I was marketing and sales manager at Lomas de Carara in Tarcoles, now Nativa Resort, we had to make a decision. Our market was North American client-oriented. It would be a big plus to offer title insurance on the properties we were selling.

Around the same time, Stewart Title, now Secure Title, was starting their operation in Costa Rica, which seemed a perfect solution. It gave the real estate developer an advantage over others, as it offered comfort to our buyers. Insurance of the title gives a North American buyer more comfort when buying property. Therefore, we included title insurance in every sale we made.

Is title insurance a scam?

Even in the U.S, where title insurance is customary and often even mandatory, if there is a mortgage involved, times are changing. Online records allow title insurance companies to do their due diligence in a record time.

In Maggie Wilsons’ opinion, title insurance is a scam, read here why.

Costa Developers

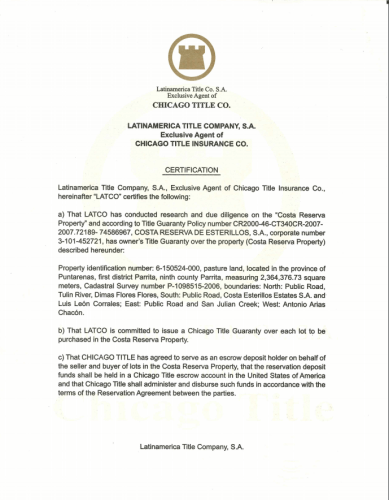

As an example, the real estate development company Costa Developers, master-planned and started building Costa Reserva Esterillos. When selling the building lots, they offered title insurance through LATCO (Latin American Title Company S.A.), the exclusive agent of Chicago Title Insurance Co. Escrow was offered in Panama.

I used this case only as a sample to show you why title insurance has no value at all. LATCO only certified that the title was clear on the master property and committed to issuing Title Guaranty over each lot in Costa Reserva.

As of today, hundreds of Costa Reserva Esterillos title holders are waiting for the real estate developer to finish the infrastructure. Unfortunately, Costa Developers have disappeared from the face of the earth.

So, what is title insurance good for if these lots have clear titles, but there is zero infrastructure?

Unnecessary

Costa Rican real estate attorney Roger Petersen explains it very well in this article.

“Costa Rica follows the doctrine of first in time first in right which means that documents that were not recorded against title at the time you purchase a property cannot be charged upon an innocent buyer who purchased in good faith.”

A simple explanation

I have really never believed in title insurance in Costa Rica. I know all the work a title company does in the United States for example. Here, it is the closing attorney–notary public who does all the hard work.

Let me give you a simple explanation. A good real estate agent will check the title before writing up an offer. After having an accepted offer by both parties, the next step is to write up a formal option to purchase – sale agreement. This is when the notary public checks the title. If there is a problem with the title, the notary public will not even write up the document.

The title company does not even get into the picture until closing. For very little work, a title insurance company in Costa Rica makes a 1% fee for a real estate purchase. So they earn $5,000 on a $500,000 home sale by just pulling a title study from the National Register. Depending on what they’d find, the title company could either extend title insurance or say they wouldn’t cover it, although we already knew the property had a clear title.

Is title insurance available?

The last time I heard, there is no title insurance available in Costa Rica anymore. Stewart Title, the title insurance leader for years, is now a trust company and changed its name to Secure Title Latin America. They also do real estate closings. They mainly hold property titles in trust for banks like Scotiabank. I am not sure what happened with Latco, as they were recently involved in a big scandal with the Banco National de Costa Rica. Would you feel comfortable to trust your money to them?

Does it cover amenities?

Title insurances only cover title. Who certifies that the amenities of a real estate development belong indeed to the common areas?

For years, homeowners in Nativa Resort paid for the maintenance of a large swimming pool that was built on a property owned by the developer and not in the common area.

There are many communities, often in beach areas, where the water well is controlled by the real estate developer, and not by the homeowners.

Unfinished developments

During the 2016 – 2018 boom, quite a few real estate developers started a beautiful development, full of promises. When the bubble burst, the developers walked and the title holders, with or without title insurance, got stuck with a property of zero value.

I’m just saying…

Is Costa Rica untrustworthy?

When reading this, you’d think that buying a property in Costa Rica is not a good idea. As long as you do your homework, hire the right lawyer and ask the lawyer to do his/her homework, you’ll be perfectly okay. Do not write a check to a real estate developer, a real estate agent, or a property seller, without that homework.

So what now?

How do you know you are buying a property with a clear title? An American-European real estate agent always checks the title when listing the property. Then, the agent again runs a title check when the buyer makes the offer.

Your real estate attorney – notary public, who closes the purchase, will do two title checks. The first one when he/she writes up the option to purchase – sale agreement. The second one just before closing.

You can also run your own title check. Learn here how to do so.

Contact us for all your Costa Rica real estate transactions.